Are You Covered If Someone Else Crashes Your Car?

Are You Covered If Someone Else Crashes Your Car?

Letting a friend or family member borrow your car might seem harmless, but what happens if they crash it? Understanding how car insurance works in these situations can save you from a financial headache. In this article, we'll break down driver liability, policy coverage, and some unusual claims scenarios.

Does Insurance Follow the Car or the Driver?

In most cases, car insurance follows the vehicle, not the driver. This means that if someone borrows your car with permission and gets into an accident, your insurance typically covers the damages first. However, there are exceptions based on your specific policy and the type of coverage you have.

Key Factors That Determine Coverage

1. Permissive vs. Non-Permissive Use

- If you gave permission, your insurance is likely the primary coverage.

- If the driver took your car without consent, their own insurance may be responsible, or you may need to file a claim under your own policy.

2. Types of Insurance Coverage

- Liability Coverage: Pays for damage to other vehicles or property if your driver is at fault.

- Collision Coverage: Covers repairs to your vehicle regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents like theft or weather damage.

3. Excluded Drivers

- Some policies list excluded drivers who won’t be covered, even if they crash your car.

- Lending your car to an excluded driver could mean paying out-of-pocket for all damages.

What If the Other Driver Has Their Own Insurance?

If the person driving your car has their own insurance policy, it may serve as secondary coverage after yours has been exhausted. However, this depends on the specifics of both policies and how liability is determined.

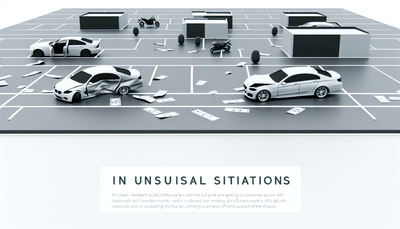

Unusual Claims Scenarios

1. Borrowed by a Friend, Crashed by a Stranger

Imagine lending your car to a friend, only for them to let someone else drive it, who then causes an accident. In such cases, your policy still applies first, but complications can arise depending on the circumstances.

2. Valet or Mechanic Accidents

If a valet or mechanic crashes your car, their employer’s insurance is usually responsible. However, if their coverage is inadequate, your policy may need to step in.

3. Stolen Vehicle Accidents

If your car is stolen and involved in an accident, you’re typically not liable. The at-fault party would be the thief, but your comprehensive coverage will help repair or replace your car.

Conclusion

Whether you're covered when someone else crashes your car depends on numerous factors, including permission, insurance types, and policy specifics. To avoid surprises, review your policy details and ensure you're aware of any exclusions or conditions. When in doubt, consult your insurance provider to clarify your coverage before handing over the keys.