Driving Through a Tornado: Does Your Policy Cover Extreme Weather?

Introduction

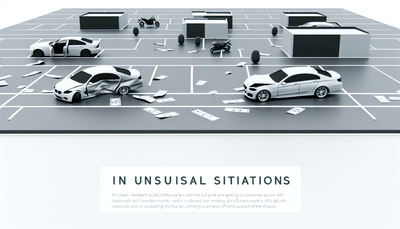

Extreme weather events like tornadoes can strike with little warning, leaving drivers in terrifying situations. If you ever find yourself caught in a tornado while driving, your safety should be the top priority—but what happens to your vehicle if it sustains damage? Will your auto insurance cover the destruction caused by such a powerful force of nature? Let's explore how insurance policies handle extreme weather and whether you're financially protected in such an event.

Understanding Comprehensive Auto Insurance

Most standard auto insurance policies include two major types of coverage: liability and comprehensive. Liability covers damages you cause to others, but it won't help if a tornado destroys your car. Comprehensive insurance, on the other hand, is designed to cover non-collision-related damages, including natural disasters like hurricanes, floods, and tornadoes.

If you have comprehensive auto insurance, your policy likely covers tornado damage. This means that if high winds, flying debris, or hail associated with a tornado wreck your car, your insurer may pay for repairs or even replace the vehicle if it's totaled—minus your deductible.

What’s Typically Covered?

If your policy includes comprehensive coverage, the following types of damage from a tornado are generally covered:

- Total vehicle loss – If the tornado causes irreparable damage, your insurer may provide compensation based on the car's market value.

- Falling debris damage – Trees, street signs, or even parts of buildings blown by strong winds can destroy vehicles.

- Hail damage – Tornadoes often bring hail, which can dent your car’s exterior and shatter windows.

- Flooding damage – Heavy rain accompanying a tornado could lead to water damage inside your vehicle.

Exclusions and Limitations

While comprehensive coverage protects against most tornado-related damage, there are some potential exclusions:

- Lapse in coverage – If you only have liability insurance, tornado damage is not covered.

- Deductibles – You’ll need to pay your deductible before receiving a payout.

- Rental reimbursement – If your car is in the shop after a storm, rental costs may not be included unless you opted for additional coverage.

Steps to Take If Your Car Is Damaged in a Tornado

If your vehicle is damaged in a tornado, follow these steps to ensure a smooth claims process:

- Ensure Your Safety – Avoid hazardous areas and seek shelter immediately.

- Document the Damage – Take photos and videos of the destruction.

- Contact Your Insurer – Report the incident as soon as possible to begin the claims process.

- Review Your Policy – Understand your coverage limits and deductible requirements.

- Work with Adjusters – An insurance adjuster will assess the damage and determine your compensation.

Conclusion

Tornadoes are unpredictable and potentially devastating, but having the right insurance coverage can provide financial peace of mind. If you live in a tornado-prone area, ensuring you have comprehensive coverage is crucial. Always review your policy details and consult with your insurer to understand your specific coverage options. Being prepared can make all the difference when extreme weather strikes unexpectedly.