Borrowed a Friend’s Car and Crashed? What Happens Next

Borrowed a Friend’s Car and Crashed? What Happens Next

Introduction

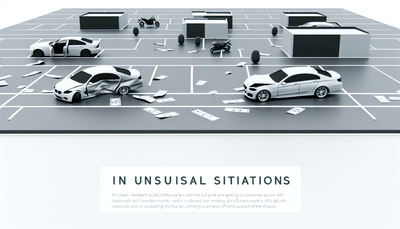

Borrowing a friend’s car might seem harmless—until an accident happens. Whether it’s a minor fender bender or a major collision, knowing how car insurance applies in this situation can save you from hefty costs and legal headaches. So, who pays for the damage? Does your insurance cover it, or does the owner’s policy kick in? Let's break it down.

Understanding Insurance Coverage on a Borrowed Vehicle

When you borrow a friend’s car and get into an accident, determining coverage depends on the car owner's insurance policy and whether you have your own auto insurance. Here’s how it generally works:

The Car Owner’s Insurance Comes First

Most auto insurance policies follow the vehicle, not the driver. This means the car owner's policy is the primary coverage for damages related to the accident.Your Own Insurance May Provide Secondary Coverage

If the damages exceed the limits of the car owner's insurance, your personal auto insurance (if you have one) may provide secondary coverage.Permission Matters

If you had permission to drive the car, the owner's insurance should still apply. However, if you took the car without consent, the situation becomes more complicated and may not be covered by their policy.

What If the Owner’s Insurance Doesn’t Cover It?

Some policies have exclusions for non-listed drivers or specific accident scenarios. If the owner’s insurance doesn’t cover the accident fully:

- You may have to pay out-of-pocket for repairs and medical expenses.

- Your own insurance might help—if you have applicable coverage.

- The owner could be forced to pay for damages if their policy denies the claim.

Steps to Take After the Accident

If you find yourself in this unfortunate situation, follow these steps to ensure everything is handled properly:

Ensure Safety First

Check for injuries and call emergency services if needed.Exchange Information

Gather details from the other driver(s), including insurance information, names, and contact details.Notify the Car Owner

Inform your friend about the accident right away so they can contact their insurer.File an Insurance Claim

Work with the owner to report the accident to their insurance provider. If necessary, notify your own insurer as well.Understand Liability and Costs

Discuss with the owner how repair costs will be handled, especially if their policy has high deductibles or doesn’t fully cover damages.

Conclusion

Crashing a borrowed vehicle can be a stressful experience, but understanding how car insurance works in this scenario can help minimize confusion and unexpected costs. The owner’s insurance is typically the first line of defense, but there are cases where your own policy or even personal funds may come into play. Always drive responsibly, ensure the car owner’s insurance is active, and know what steps to take in case of an accident.

By staying informed, you can avoid unpleasant surprises and navigate this tricky situation more effectively.